CIS-CPG reality - ServiceNow Certified Implementation Specialist - Cloud Provisioning and Governance (CIS-CPG) Updated: 2024

|

|

|

|

|

|

|

|

ServiceNow Implementation reality

Other ServiceNow exams

ServiceNow-CSA ServiceNow Certified System Administrator 2023Servicenow-CAD ServiceNow Certified Application Developer

Servicenow-CIS-CSM Certified Implementation Specialist - Customer Service Management

Servicenow-CIS-EM Certified Implementation Specialist - Event Mangement

Servicenow-CIS-HR Certified Implementation Specialist - Human Resources

Servicenow-CIS-RC Certified Implementation Specialist - Risk and Compliance

Servicenow-CIS-SAM Certified Implementation Specialist - Software Asset Management

Servicenow-CIS-VR Certified Implementation Specialist - Vulnerability Response

Servicenow-PR000370 Certified System Administrator

Servicenow-CIS-ITSM Certified Implementation Specialist IT Service Management

ServiceNow-CIS-HAM Certified Implementation Specialist - Hardware Asset Management

CIS-RCI ServiceNow Certified Implementation Specialist - Risk and Compliance (CIS-RCI)

CAS-PA ServiceNow Certified Application Specialist - Performance Analytics

CIS-FSM ServiceNow Certified Implementation Specialist - Field Service Management

CIS-VRM ServiceNow Vendor Risk Management

CIS-CPG ServiceNow Certified Implementation Specialist - Cloud Provisioning and Governance (CIS-CPG)

What must be created in Azure before you can configure Azure Alerts in ServiceNow?

A. Create a Network Security Group

B. Create a Resource Group

C. Create an App Service

D. Create a Monitor Alert

Answer: D

Question: 172

How can the required parameters for a CAPI Operation be determined?

A. The Cloud Provider documentation and testing

B. Reference the parameters used by another CAPI Operation

C. ECMA script product documentation

D. ServiceNow product documentation

Answer: D

Question: 173

Which JavaScript Class can be used to make a REST API call to AWS with the least amount of code?

A. CloudAPIBase

B. AmazonCloudAPI

C. AmazonWebServicesAPIInvoker

D. AWSCloudAPIBase

Answer: C

Question: 174

When creating a new CAPI API, what is the suggested starting version number to prevent conflicts with out-of-the-

box CAPI APIs?

A. 2.0

B. 1.5

C. 0.1

D. 1.1

Answer: A

Question: 175

What governance objects are available in Cloud Provisioning and Governance? (Choose three.)

A. Quotas

B. Credentials

C. Policies

$13$10

D. Permissions

E. SLAs

Answer: C

Question: 176

Which object is rendered as a tab on the request form of a Cloud Catalog Item?

A. Tab Set

B. Tab Group

C. Variable Group

D. Variable Set

Answer: C

Question: 177

When deploying an IIS Web Server in AWS for public access, which of the following must be configured to allow

users to access the Web Server?

A. TLS Certificate

B. Security Group that allows inbound traffic

C. Network Traffic Group that allows inbound traffic

D. Windows Host Based Firewall

Answer: D

Question: 178

What would you review to quickly determine which group is deploying the most stacks?

A. Cloud Operations Dashboard

B. Cloud Activities

C. Cloud Request Items

D. Cloud Orchestration Trail

Answer: A

Question: 179

What objet does a Catalog Item utilize to dynamically set values for a Resource Block attribute?

A. Methods

B. Expressions

C. Functions

D. Operations

Answer: A

Question: 180

$13$10

A customer on the New York release of CPG currently uses Blueprints to deploy Azure VMs.

What deployment options are available to the customer when they upgrade to the latest release of CPG? (Choose two.)

A. Jenkins Workflow

B. The Azure Blueprint Service

C. Puppet Manifest

D. Azure ARM Templates

E. Customers cannot upgrade from New York

F. Terraform Config file

Answer: A,C

Question: 181

After ingesting a new version of a Template, what can be done to ensure that the Order Form reflects the changes that

were introduced in the new version of the Template?

A. Modify the Catalog Itemâs Cloud Variables

B. Deactivate and activate the Catalog Item

C. Refresh the browser

D. Activate the template version

Answer: D

Question: 182

For Cloud Provisioning and Governance in the Orlando release or later, where can you utilize an Application Profile?

A. Server side include

B. MID Server script include

C. Blueprints stage operations

D. Post-provision operation

Answer: D

Question: 183

In AWS, the region-specific containers for virtual resources are called regions.

In Cloud Provisioning and Governance, regions are called what?

A. Regions

B. Segments

C. Logical Datacenters

D. Cloud Centers

Answer: C

Question: 184

Which three CAPI components must be configured to create a CAPI Extension?

$13$10

A. CAPI Vendor, CAPI Interface, and CAPI REST API

B. CAPI Product, CAPI Method, and CAPI API

C. CAPI Vendor, CAPI Interface, and CAPI API

D. CAPI Provider, CAPI Interface, and CAPI API

Answer: A

Question: 185

The Azure Resource Manager uses what to organize the cloud resources required to deploy a VM?

A. Resource Pool

B. Storage Account

C. Placement Group

D. Resource Group

Answer: A

$13$10

Thapana Onphalai

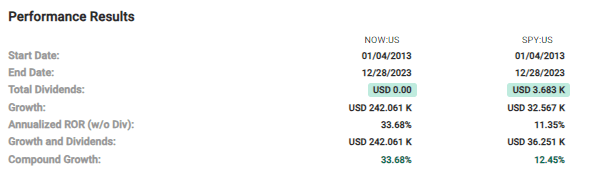

I've written about ServiceNow (NYSE:NOW) a couple of times, and I am continually impressed every time I revisit them. I first bought shares in 2018, with that lot up 280% from purchase. I've added to that position, and the company is in my kids' long-term portfolios. Among software companies, NOW ranks with Adobe (ADBE) and Salesforce (CRM) in relative safety while maintaining double-digit revenue growth. The strength of the company's growth combined with its wide-moat and financial stability commands a premium in the market.

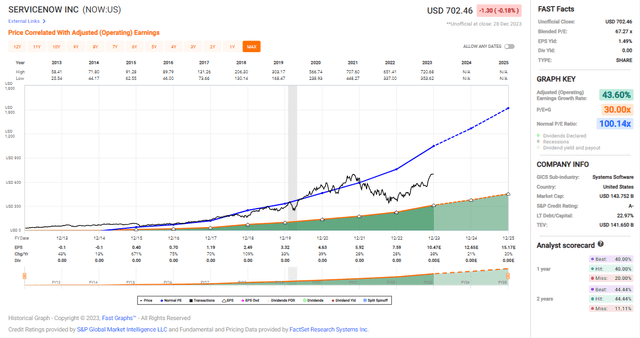

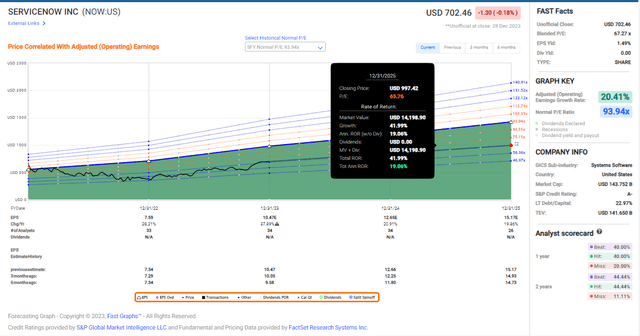

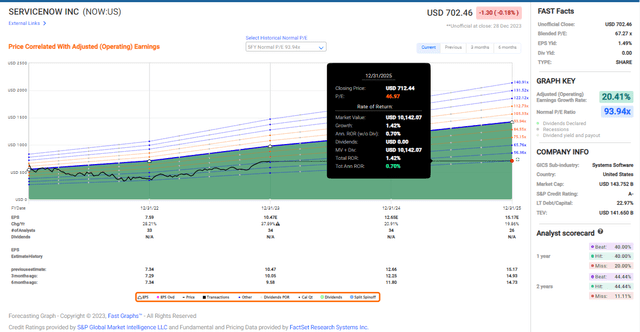

FAST Graphs

The performance has been incredible, and the metrics look great, so what could go wrong?

What I am looking at is an ultimately inevitable growth cliff. When a company like NOW hits 85% of customer penetration in the Fortune 500, the next question is where the company goes next.

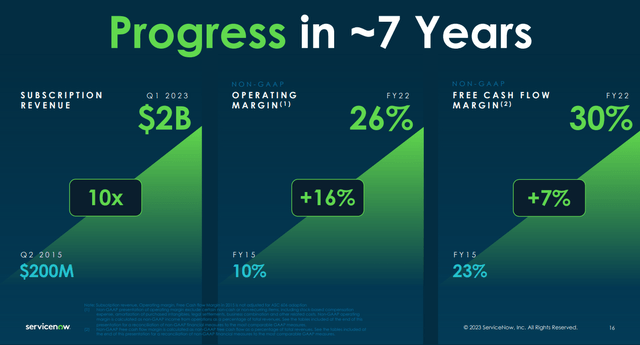

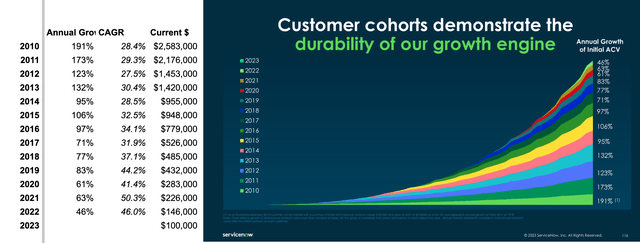

Company Presentation

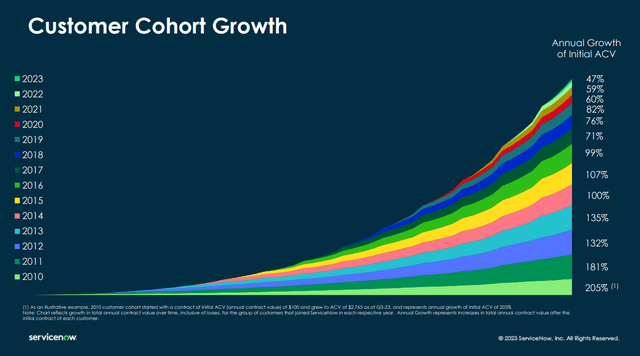

For one thing, as new software launches in generative AI bolster the company's offerings in areas like HR, customer service, and operations, upsell continues to be a strong suit for NOW. Typically, successful software as a service (SAAS) companies operate on a land-and-expand strategy, where the initial offering (in this case, IT services management) gets the foot in the door and the company continues to roll out and upsell.

Looking above, with a historical 97-99% retention rate for customers and high net revenue retention, early customer cohorts have continued to grow their subscriptions over time. This provides a nice tailwind to revenue growth to make up for any churn and smooth out new customer acquisition.

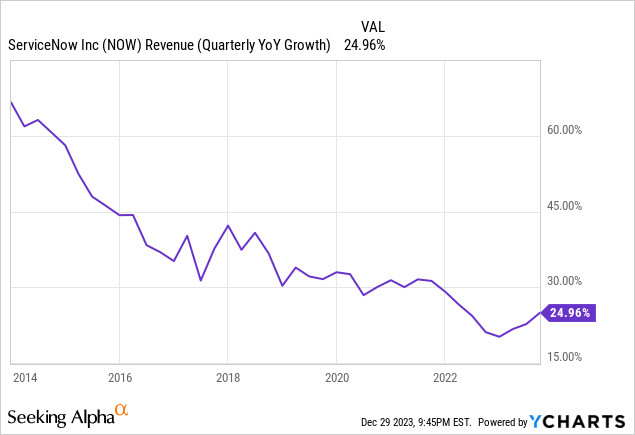

Looking over the past 10 years, though, revenue growth has slowed. It's inevitable, and as NOW has grown into a mega-cap, it's highly likely we see revenue growth rates continue to trend down slowly over the medium-to-long term.

However, recent deal flow has remained impressive. The company reported in its most recent quarter closing 83 deals with over $1M in annual contract value (ACV), with 14 of the top 20 deals including all 7 workflows (ITSM, ITOM, ITAM, security and risk, customer, employee, and creator). There's no stronger sign of a company's reputation than new customers' willingness to dive in on the whole stack. Additionally, the company closed 19 Federal deals >$1M in ACV with 3 of those over $10M including a deal with the Air Force ranking in as their third largest in company history. Although opportunities with the government aren't going to break open a company-altering growth avenue, churn is negligible with a 99% retention rate.

With that deal flow, subscription revenue growth came in at 24.5% yoy, with Federal growing 75%. Management discussed opportunities in industry-specific solutions like legal, finance, and procurement. I think industry-specific solutions are nice, but they also aren't going to set the world on fire for growth, considering the company's size at this juncture. However, internationally, the company generates around 26% of revenues in EMEA and 11% in APAC at this point, so strong traction outside the US is good to see for long-term growth. Some additional color from the earnings call:

You know, one thing that might be of interest to you is, in America, the number of 5 million-plus deals actually more than quadrupled year over year. And the number of 10 million-plus deals doubled year over year. And I think, as CJ laid out beautifully, technology and employee workflows were enormously successful. And in EMEA, our 1 million-plus deals grew 70% year over year, which means that the platform and multiple components of the solutions that are great engineering team builds is resonating.

And we're seeing particular uplift now in government and manufacturing. And one, you know, interesting fact, we have these world forums coming up in London, Paris, Frankfurt, and Rotterdam, and we have a billion-plus pipeline that's registered for those events. So, we feel good about that. And APJ, when you think about it, the 1 million-plus deals increased 40% year over year.

And Japan is continuing to impress us with the unprecedented opportunity of the world's third-largest economy, as -- Germany as well. So, we're seeing lots of real growth opportunities on the global stage, and I think Gina pointed that out earlier as well.

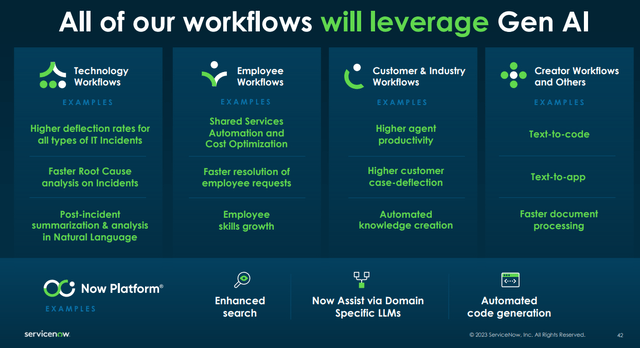

Company presentation

The company's incorporation of generative AI into its offerings is good to see for maintaining its edge going forward. All the talk about growth would be for naught if NOW's offerings lost their lead against the competition. The company's website has some good videos showing use cases, but it's about what you'd likely expect. Customers, employees, etc. are able to use a chat box (AI assistant) to accomplish tasks that may have required scrolling an FAQ page or talking to a live person before. Additionally, they are leveraging AI to auto-summarize tickets, articles, etc. which I think could have some pretty substantial productivity gains. Here's some discussion on AI from the earnings call:

What's unique about ServiceNow is digital transformation can deflect so many of the cost-intensive, labor-intensive procedures that companies have to deal with to properly serve their market. On top of that, you have one-third of the productivity of knowledge workers getting torn apart by swivel-sharing between, on average, 13 individual applications a day. Now, you add the productivity tailwind of generative AI on this once-in-a-generation ServiceNow platform and you have achieved a very important business transformation. And I think, right now, CEOs are focused on business transformation. And when you can give them one common UX that is consumer grade that integrates with the half-a-century-old legacy mess that they have to contend with, and we can get the actions that they need done done done to achieve cost out productivity and the growth on, they're all about ServiceNow now. And that's why you're seeing these results, and they are sustainable.

Company presentation

All that is to say NOW continues to impress me. My main concern as the company branches out into customer service and HR is the specter of competition from other major software companies, notably CRM. I think NOW has proven itself capable of competing, but growth will not be as easy against entrenched SaaS-native operators as it was stealing share from the legacy offerings.

That being said, I don't see a growth cliff in the near term. Deal flow remains strong, and the company's new offerings continue to push out the TAM further and further.

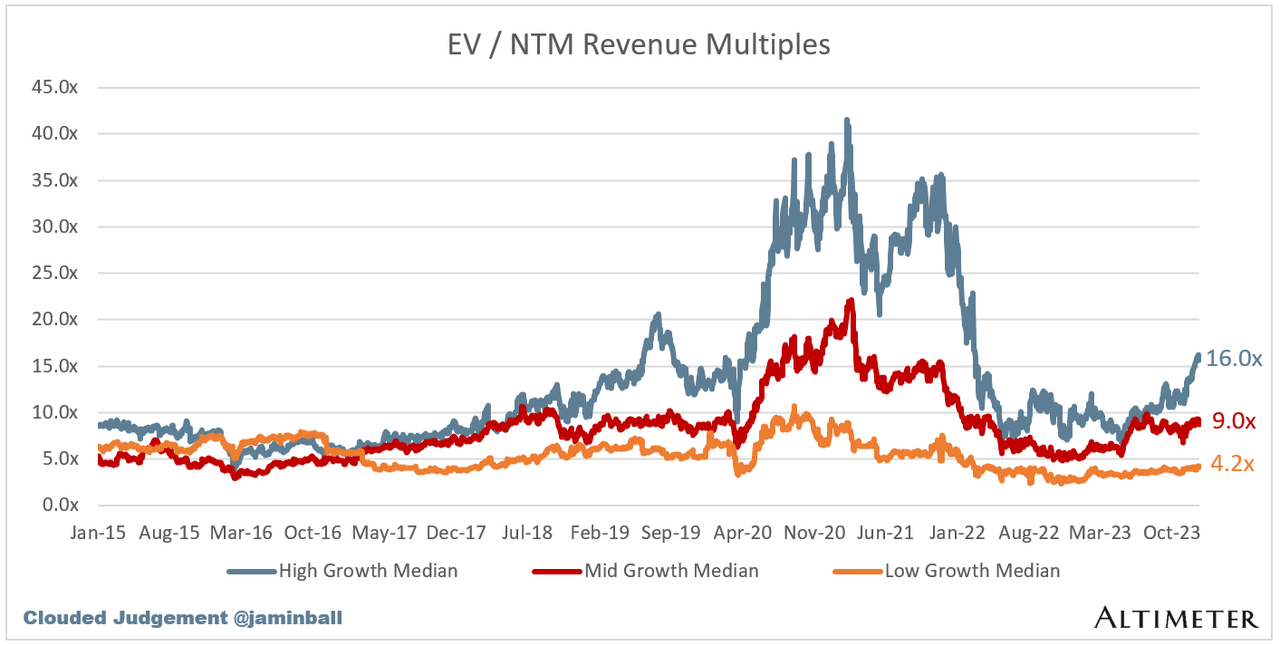

Clouded Judgement Substack

Looking at valuations across the space, the high-growth cohort has ticked back up into the tail end of the year, but overall valuations are about average compared with the long-term averages. NOW falls into the mid-growth cohort (just shy of the 25% cutoff for this grouping).

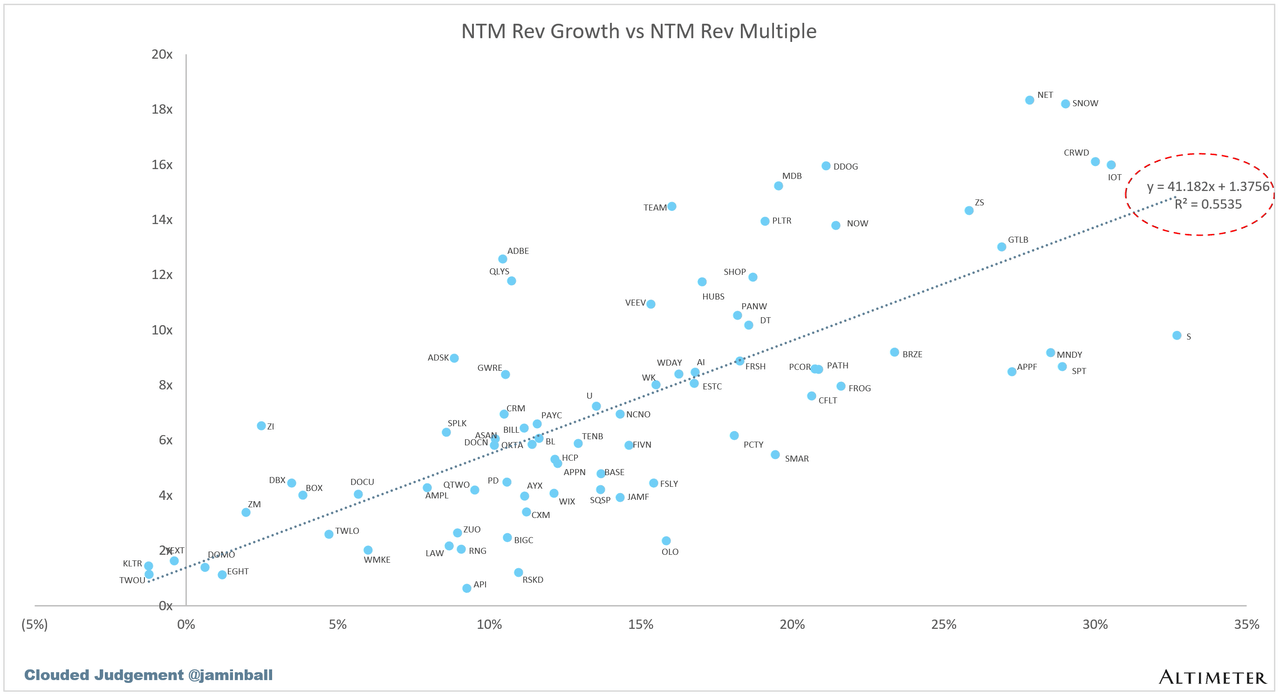

Clouded Judgement Substack

Looking at the scatter plot of growth versus valuation (against sales) above NOW falls out above the mean, but deservedly so. For one thing, the company is actually profitable on a GAAP basis, which is not the norm. Looking at some comps, the company is growing way faster but is priced about the same as ADBE. It's also growing faster and priced about the same as PLTR and TEAM, as well. NOW's operating metrics against PLTR's aren't even comparable, but I'll leave you to draw whatever conclusions you want from that. Most of the companies residing below the curve are more speculative and less safe.

FAST Graphs

As far as profitability, NOW's GAAP operating margin is only at 8%. The company still spends 37% of its revenues on sales and marketing and 24% on R&D, which are aggressive but relatively in line with other SaaS companies. Its G&A expenses are at 10% of revenues against the median of 16%, which is a good sign of cost controls. However, stock-based compensation of 18% of revenues is still pretty substantial and shows the company is heavily investing in personnel to maintain its growth rates.

I'd anticipate there are many levers the company can pull to improve profitability further once growth slows down, but ultimately the company is still trying to dominate as many areas as it can. I am happy to see management has a $1.2B share repurchase authorization in place to offset dilution for shareholders from SBC.

Earnings growth rates have been strong from a small base, and the company has historically traded for high-flying 100X earnings.

FAST Graphs

The concern with a company trading for such a lofty multiple is the ease with which it could compress. In the blink of an eye, the company could go from trading at 67X earnings today to 30X earnings, and some would still call the company expensive. This is a risk you'll have to swallow to invest in many of these types of companies, and it's a very real one. All it takes is a big enough speed bump in the company's growth rates or a bad outlook. However, at current projections, if the company maintains its current P/E ratio, earnings should grow at around a 20% per year clip.

FAST Graphs

In order to illustrate the valuation risk, if the company were to trade at 47X earnings in 2025, despite the incredible earnings growth rates, investors would get zero return out of the stock.

Despite that risk, NOW is a great growth story. I've got the company in all my portfolios, and I intend to continue holding it for the long term. The valuation has ticked up a little in the recent past, but it's a buy with the long-term in mind.

JHVEPhoto

I covered ServiceNow (NYSE:NOW) last January, concluding that the stock should reach $150B market cap over the next handful of years. Less than one year later, the stock is just about there.

This is yet another case study of the irrationality of the market herd. In July of 2022, sentiment on ServiceNow was extremely negative, as CEO Bill McDermott expressed concern in "macro crosswinds" and "elongated sales cycles". What has ServiceNow done since? In April of this year, it slightly reduced its long term guidance from $16B+ in revenue by 2026 to $15B+. The long term revenue trajectory should be the most important input for investors assessing the business' value. This should have been a negative revelation, yet the stock has soared as ServiceNow has outperformed near term expectations, raising current year guidance throughout the year.

ServiceNow is an easy business to get excited about. ServiceNow's early leaders determined the platform was far more useful beyond being a traditional IT help desk. ServiceNow is an entire workflow solution, meaning it can transfer information from one party to another in a variety of applications. In addition to IT service management, this includes managing IT operations and assets, employee requests, and customer requests. ServiceNow seems to perpetually discover new avenues where its platform can be useful, which gives investors more confidence in our year growth and performance.

ServiceNow has blasted past the organic revenue growth trajectories of behemoths like Salesforce (CRM), Adobe (ADBE), and Oracle (ORCL) by continuing to penetrate the world's best enterprise and government customers. ServiceNow had its best quarter ever for new government deals:

From an industry perspective, this was the best US Federal quarter in ServiceNow's history. NNACV was up over 75% year-over-year. US Federal agencies are standardizing on a single platform with a core set of end-to-end solutions. We had 19 federal deals over 1 million, including three deals over 10 million.

Our top deal in the quarter, the United States Air Force was the third largest deal in the company's history.

It's easy to be suspicious of CEOs like Bill McDermott that talk a big game, McDermott has repeatedly testified that his dream of making ServiceNow the defining enterprise software company of this century, but thus far, execution has been about as good as it gets.

McDermott has continually expressed customer centricity as the reason for ServiceNow's success. McDermott shared a colorful antidote at a recent investor conference of an experience running a retail business as a teenager:

I had built a video game room on the side of the delicatessen and I let the kids in 40 at a time. And to really amplify the importance of treating your customer well at the end of a long day, one of the young people said to me, Bill, when we want to have good food, be treated with respect and play video games, we come to your store and when we want to steal stuff, we go to 7-Eleven. It’s all about the customer, man.

The numbers back up McDermott's claims. As an example, in this chart shared at Investor Day each year, ServiceNow's customer cohort from 2010 is spending over 25x this year than they spent their first year as a customer:

Author / ServiceNow Investor Day Presentation

It's hard not to like ServiceNow's fundamentals, it's even harder not to like its charismatic CEO. Sentiment ebbs and flows, the principles of valuation do not.

Valuation:

ServiceNow (along with the broader market) is just beginning to crest to new highs following the November 2021 peak and subsequent rate-driven sell-off.

As software valuations compressed in 2022, the debate over whether or not to classify stock-based compensation as an expense raged. It's become clearer that it should indeed be expensed, even if not a cash outflow. Here's why:

During the years ended December 31, 2022 and 2021, we issued a total of 2.7 million shares and 3.2 million shares, respectively, from stock option exercises, vesting of RSUs, net of employee payroll taxes and purchases from ESPP.

If we average out ServiceNow's stock price at the end of each quarter in 2022, we reach a price of about $592/share. Multiply this by 2.7 million shares issued, and this equals nearly $1.6B, or just slightly above the $1.4B stock-based compensation expense added back to free cash flow.

This is real value that has been transferred from shareholders to employees. In previous assessments, I may have been a bit too generous, valuing the business. This seemed to matter when valuations were falling, but investors have decided to turn a blind eye as prices have risen again.

ServiceNow trades at a steep multiple of 54x this year's FCF, 91x if excluding stock-based compensation. This compares to 80x and 216x at the peak of 2021, respectively. This is fuel for the bulls, the argument that multiples have significantly compressed at the same valuation because of significant growth.

Sticking To Principles:

It's easy to get drawn into ServiceNow's spectacular narrative and want to own the stock. But when the sky starts falling, as it periodically does in the financial markets, the sole source of conviction becomes very simple math.

The bulk of ServiceNow's value is locked up in distant future earnings. The fundamentals and management team are elite, but the possibility of a long period of underperformance after a huge rally is notable. New investors should consider waiting for a better entry point. It's very difficult to rate such a high quality businesses as a sell, but the valuation is stretched enough the investors should begin to consider the limits on their own risk tolerances if multiples continue to expand.

Utelogy now integrates with the Now Platform, enabling IT teams to leverage proactive management and monitoring of their entire technology estate within their connected IT Service Management (ITSM) platforms. This new integration, available on the ServiceNow Store streamlines daily tasks, boosts productivity, and ensures that all devices and assets are efficiently managed, ultimately increasing the ROI for businesses and enhancing the total experience for both staff and end-users in and outside of the office.

As a Strategic Platform Technology Partner, the certified Utelogy integration enables users with the ability to quickly respond to and resolve alerts by automating case creation and incident creation within ServiceNow's ITSM suite by leveraging Utelogy data.

"A seamless and responsive IT infrastructure is no longer a luxury but a necessity for businesses today," said Kevin Morrison, CEO of Utelogy. "Our integration with ServiceNow represents a significant step in enabling our customers to achieve a proactive service management stance. It’s not just about responding to issues faster; it’s about preventing them from occurring, which is the ultimate measure of IT efficiency and effectiveness. This integration ensures that the technologies our customers rely on are always at peak performance, which is essential for their daily operations."

By taking advantage of this direct connection, companies can now be better informed on potential issues before they impact end-users, thereby maintaining business continuity and user satisfaction. This integration is particularly valuable for organizations looking to consolidate their technology management and incident resolution processes into a comprehensive ITSM solution.

[5 Ways to Develop Business in the New Year]

"Partnerships succeed best when we lean into our unique skills and expertise and have a clear view into the problem we’re trying to solve," said Erica Volini, senior vice president of global partnerships at ServiceNow. "Utelogy Corporation's integration with ServiceNow extends our reach well beyond where we can go alone and represents the legacy and goals of the Now Platform. I am thrilled to see the continued innovation we will achieve together to help organizations succeed in the era of digital business."

Someone forgot to tell ServiceNow (NOW 0.69%) that the cloud software industry has been slowing down in 2023. The digital transformation platform's revenue growth has actually been accelerating throughout the last year, and the stock has picked up steam as 2024 approaches. Shares of ServiceNow are up 80% in 2023 with just weeks left to go until the new year.

A high valuation has prevented many investors from pulling the trigger on buying this top cloud stock. After an epic run, is it still a top buy for 2024?

A next-gen platform for the future of work

ServiceNow provides numerous solutions for businesses to manage their workforce and customer experiences. Its platform spans digital workflow management tools, from AI that helps find bottlenecks that are slowing down the completion of tasks to cloud observability solutions that help with app performance.

ServiceNow landed on the radar of many investors this past summer after an expanded partnership was struck with Nvidia. ServiceNow said it would adopt Nvidia's latest and greatest AI systems to improve its own platform, and in turn, Nvidia would expand its use of ServiceNow in its own workflow management for developing more powerful chips and generative AI systems.

This type of AI used to automate more employee tasks is powering "digital transformation" among big customers. In a year like 2023 where cost-cutting has been a top priority in the corporate world, it's helped keep demand high for ServiceNow's software. And, after the bear market of 2022, the company's revenue growth has been ratcheting up again.

|

Period |

Total Revenue |

Increase (YOY) |

|---|---|---|

|

2021 |

$5.9 billion |

30% |

|

2022 |

$7.25 billion |

23% |

|

Q1 2023 |

$2.1 billion |

22% |

|

Q2 2023 |

$2.15 billion |

23% |

|

Q3 2023 |

$2.29 billion |

25% |

Data source: ServiceNow. YOY = year over year. Â

Even better, though, has been ServiceNow's rapid progress on profitability. Generally accepted accounting principles (GAAP) income from operations was $492 million in the first nine months of 2023, compared to just $200 million in the same period in 2022. Free cash flow (FCF) was $1.36 billion in the first nine months of 2023 (a healthy FCF profit margin of 21%), with the discrepancy between GAAP profitability primarily driven by employee stock-based compensation.

As for that employee stock-based compensation, ServiceNow management reported it repurchased $282 million worth of stock in Q3 2023. This is part of the company's first-ever stock repurchase program, which is aimed at offsetting the impact of dilution from ongoing employee stock-based compensation. About $1.2 billion worth of stock repurchase authorization remained at the end of the quarter.

Expect some turbulence, but a top cloud stock for the long term?

After the big run-up in stock price in 2023, ServiceNow trades for a high premium of 90 times trailing-12-month earnings per share, or about 60 times trailing-12-month FCF. Of course, part of the premium exists because ServiceNow's profit margins are expected to rise rapidly over the course of the next few years. To wit, shares trade for a bit more reasonable 55 times Wall Street analysts' expectation for 2024 earnings per share.

ServiceNow is nevertheless an expensive stock as we head into the new year. That can cause some turbulence in stock price, including steep sell-offs if ServiceNow misses some short-term financial estimates from one quarter to the next.

However, given the company's fast-and-steady growth for years, and leadership in cloud-based and AI-powered software, investors are rightfully optimistic about the business's trajectory. As I explained this time last year, I think a stock like ServiceNow is best bought in batches over the course of time, perhaps using a dollar-cost averaging plan. This still seems like the right strategy for those investors interested in the long-term potential (a decade and beyond) for ServiceNow.

Summary

ServiceNow provides cloud-based software-as-a-service management applications to automate and track workflows across the enterprise, including IT, human resources, facilities, and field service, among others. The company markets to enterprises in industries ranging from financial services and consumer products to healthcare and technology. About 95% of revenue comes from subscription software sales, with the remainder from professional services. About 30% of the company's revenue is generated outside of the U.S. ServiceNow went public on June 29, 2012 at $18 per share.

Subscribe to Yahoo Finance Plus Essential for full access

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Someone forgot to tell ServiceNow (NYSE: NOW) that the cloud software industry has been slowing down in 2023. The digital transformation platform's revenue growth has actually been accelerating throughout the last year, and the stock has picked up steam as 2024 approaches. Shares of ServiceNow are up 80% in 2023 with just weeks left to go until the new year.

A high valuation has prevented many investors from pulling the trigger on buying this top cloud stock. After an epic run, is it still a top buy for 2024?

A next-gen platform for the future of work

ServiceNow provides numerous solutions for businesses to manage their workforce and customer experiences. Its platform spans digital workflow management tools, from AI that helps find bottlenecks that are slowing down the completion of tasks to cloud observability solutions that help with app performance.

ServiceNow landed on the radar of many investors this past summer after an expanded partnership was struck with Nvidia. ServiceNow said it would adopt Nvidia's latest and greatest AI systems to improve its own platform, and in turn, Nvidia would expand its use of ServiceNow in its own workflow management for developing more powerful chips and generative AI systems.

This type of AI used to automate more employee tasks is powering "digital transformation" among big customers. In a year like 2023 where cost-cutting has been a top priority in the corporate world, it's helped keep demand high for ServiceNow's software. And, after the bear market of 2022, the company's revenue growth has been ratcheting up again.

|

Period |

Total Revenue |

Increase (YOY) |

|---|---|---|

|

2021 |

$5.9 billion |

30% |

|

2022 |

$7.25 billion |

23% |

|

Q1 2023 |

$2.1 billion |

22% |

|

Q2 2023 |

$2.15 billion |

23% |

|

Q3 2023 |

$2.29 billion |

25% |

Data source: ServiceNow. YOY = year over year.

Even better, though, has been ServiceNow's rapid progress on profitability. Generally accepted accounting principles (GAAP) income from operations was $492 million in the first nine months of 2023, compared to just $200 million in the same period in 2022. Free cash flow (FCF) was $1.36 billion in the first nine months of 2023 (a healthy FCF profit margin of 21%), with the discrepancy between GAAP profitability primarily driven by employee stock-based compensation.

As for that employee stock-based compensation, ServiceNow management reported it repurchased $282 million worth of stock in Q3 2023. This is part of the company's first-ever stock repurchase program, which is aimed at offsetting the impact of dilution from ongoing employee stock-based compensation. About $1.2 billion worth of stock repurchase authorization remained at the end of the quarter.

Expect some turbulence, but a top cloud stock for the long term?

After the big run-up in stock price in 2023, ServiceNow trades for a high premium of 90 times trailing-12-month earnings per share, or about 60 times trailing-12-month FCF. Of course, part of the premium exists because ServiceNow's profit margins are expected to rise rapidly over the course of the next few years. To wit, shares trade for a bit more reasonable 55 times Wall Street analysts' expectation for 2024 earnings per share.

ServiceNow is nevertheless an expensive stock as we head into the new year. That can cause some turbulence in stock price, including steep sell-offs if ServiceNow misses some short-term financial estimates from one quarter to the next.

However, given the company's fast-and-steady growth for years, and leadership in cloud-based and AI-powered software, investors are rightfully optimistic about the business's trajectory. As I explained this time last year, I think a stock like ServiceNow is best bought in batches over the course of time, perhaps using a dollar-cost averaging plan. This still seems like the right strategy for those investors interested in the long-term potential (a decade and beyond) for ServiceNow.

Should you invest $1,000 in ServiceNow right now?

Before you buy stock in ServiceNow, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and ServiceNow wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 7, 2023

Nicholas Rossolillo and his clients have positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and ServiceNow. The Motley Fool has a disclosure policy.

Is ServiceNow Stock a Top Buy for 2024? was originally published by The Motley Fool

CIS-CPG reality | CIS-CPG information | CIS-CPG plan | CIS-CPG exam success | CIS-CPG resources | CIS-CPG candidate | CIS-CPG information hunger | CIS-CPG Free PDF | CIS-CPG study tips | CIS-CPG mock |

Killexams Exam Simulator

Killexams Questions and Answers

Killexams Exams List

Search Exams