CIFC syllabus - Canadian Investment Funds Course (CIFC) Updated: 2024

|

|

|

|

|

|

|

|

IFSE Investment syllabus

Other IFSE exams

CIFC Canadian Investment Funds Course (CIFC)All else being equal, which of the following mutual funds would Harry most likely choose

A. Fund A- MER 0.5 %

B. Fund D- MER 0.25 %

C. Fund B- MER - 2 %

D. Fund C- MER 1.5 %

Answer: B

Question: 28

" Having to subpoena witnesses, seize documents for examination and operate as administrative tribunals " is most

likely related to which of the powers of securities administrators

A. Enforcement

B. Registration

C. Resinding

D. Disclosure

Answer: A

Question: 29

Which of the following transaction is not shown in T3/ T5 document

A. Harry sells his fund units at 15 NAVPS, cost of acquisition was 11 NAVPS

B. Fund makes a distribution of 1 dollar in interest income

C. Fund makes a distribution of 6 dollars in capital gains

D. Fund makes a distribution of 2 dollars in dividend income

Answer: A

Question: 30

Which of the following is not part of Duty of care primary value

A. Know your client

B. Unsolicited orders

$13$10

C. Respect for clients assets

D. Due diligence

Answer: C

Question: 31

" Ensuring that all documents and other required information are prepared in accordance with requirement and

provided to the appropriate parties in timely manner " is most likely related to which of the powers of securities

administrators

A. Registration

B. Enforcement

C. Resinding

D. Disclosure

Answer: D

Question: 32

Harry is a new Mutual fund dealer, he is advising Caitlin on covered call mutual fund, he suggested she buy a mutual

fund in which his partner is the fund manager and has higher fees. He is most likely in breach of

A. Duty of care

B. Professionalism

C. Integrity

D. Confidentiality

E. Compliance

Answer: C

Question: 33

" Reviewing the applicants integrity, financial solvency and general competence " is most likely related to which of the

powers of securities administrators

A. Enforcement

B. Disclosure

C. Registration

D. Resinding

Answer: C

Question: 34

Harry is a Mutual fund dealer, commingled his clients assets with his assets, which was in violation of SRO rules. He

is most likely in breach of

A. Professionalism

B. Integrity

C. Duty of care

D. Compliance

$13$10

E. Confidentiality

Answer: D

Question: 35

Harry has decided to invest 500 in an index fund tracking SAP 500 every month, he is most likely following

A. Fixed dollar withdrawal

B. One time investment

C. Dollar cost averaging

D. Ratio Withdrawal

Answer: C

Question: 36

Harry has just cleared the IFIC exam but is not registered yet, he starts recommending mutual funds to his friends, is

usually a breach of which of the following prohibited practices

A. Offer to repurchase

B. Promising a future price

C. Provision on non monetary benefits

D. Selling without being registered

E. Advertising the registration

F. Quoting a future price

Answer: D

Question: 37

Which of the following is usually associated with "implicit cot of the fund "

A. Frequent trading fees

B. Redemption fee

C. Account closing fee

D. Trustee fee

E. Acquisition fee

F. Trading expense ratio

G. Management Expense Ratio

H. Transfer fee

Answer: F

Question: 38

Based on Philosophies of equity investing the statement " Investors seek companies in sectors entering a period of

expansion, which have limited competition, high quality of R And D, low labor cost and strong return on invested

capital. They usually show above normal earnings growth " is most likely associated with

A. Growth Investing

B. Momentum investing

$13$10

C. Growth at a reasonable price

D. Value investing

E. Sector rotation

Answer: A

Question: 39

Which of the following risk is reduced by avoiding to specialize in corporate bonds

A. Unique risk

B. Exchange rate risk

C. Default risk

D. Interest rate risk

E. Market risk

Answer: C

Question: 40

Harry is a new Mutual fund dealer, he is advising Caitlin on covered call mutual funds, he puts his commissions at the

forefront while suggesting her products. He is most likely in breach of

A. Confidentiality

B. Duty of care

C. Compliance

D. Professionalism

E. Integrity

Answer: E

Question: 41

Based on the risk return metrics, identify the highest risky mutual fund

A. Dividend funds

B. Real estate funds

C. Speciality Funds

D. Equity funds

Answer: C

Question: 42

Harry is invested in a mix of bonds of canadian governments and corporations, which of the following index is most

like suitable for measuring his performance

A. MSCI World ESG Index

B. SAP 500

C. MSCI canada ESG Leaders Index

D. S&P / tsx composite

E. FTSE Canada Universe bond Index

$13$10

F. SAP / TSX 60

G. FTSE Canada 91 days T - bills index

Answer: E

Question: 43

Style drift is usually associated with

A. Change in managers investment style over a period of time

B. Change in way of calculating MER

C. Change in fund management team

D. Change in top holding of a fund

Answer: A

Question: 44

Harry, a Mutual fund dealer, showed his clients AUM with him while bragging at a party he was attending. He is most

likely in breach of

A. Duty of care

B. Professionalism

C. Integrity

D. Confidentiality

E. Compliance

Answer: D

Question: 45

Which of the following risk is generally associated with " Changes in relative value of the currencies of the countries

on investment "

A. Default risk

B. Exchange rate risk

C. Unique risk

D. Market risk

E. Interest rate risk

Answer: B

$13$10

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Establishing Connection...

Constructing a syllabus is an important component of the course design process. The following materials reflect a research-supported framework to help create a pathway to success in your course. Each semester, Innovative Learning reviews the syllabus framework, identifying needed updates and resources.

The Word files linked below outline Required and Recommended components for your syllabus. Many of these components are already in your Brightspace shell. They just need updates specific to your course. The files below include language that comes directly from University policies or is suggested by the University Senate or specific units. Other sample language reflects an autonomy-supportive classroom that can influence student perception and performance (Young-Jones, Levesque, Fursa & McCain 2019). Italicized text indicates notes to instructors. Plain text provides examples of language.

Tips for creating your syllabus:

- Don’t revise what you don’t have to. Resources listed under University Policies and Statements and the Student Services widget in the Brightspace shell are updated each semester and automatically populated. You may call these resources to your students’ attention.

- Instructors cannot see the Student Services widget in Brightspace, but you can see the most recent version of it here.

- Feel free to add additional resources that might help your students to your syllabus.

Once your syllabus is complete, please also upload it to Purdue’s Course Insights syllabus archiving system. For questions related to the syllabus framework, email innovativelearningteam@purdue.edu.

Note: The Purdue syllabus guidelines are influenced by Instruction Matters: Purdue Academic Course Transformation (IMPACT) and the resources available through Purdue’s Brightspace learning management system (LMS). It also addresses criteria of the valid and reliable syllabus rubric published by the University of Virginia Center for Teaching Excellence (Palmer, Bach & Streifer 2017). Components fall under five categories: 1) Essential course information, instructor contact information, and course description, 2) Specific, student-centered learning outcomes and objectives that are clear, articulated and measurable (Bristol et al 2019), 3) Assessment strategies for all graded assignments that make explicit connections between learning outcomes, activities, and content, 4) Pedagogical approaches and activities that help students achieve the course outcomes and objectives, and 5) Policies and approaches that foster engaging, student-centered learning environments.

References

Adena Young-Jones, Chantal Levesque, Sophie Fursa & Jason McCain (2019): Autonomy-supportive language in the syllabus: supporting students from the first day. Teaching in Higher Education. DOI: 10.1080/13562517.2019.1661375.

Levesque-Bristol, C., Flierl, M., Zywicki, C., Parker, L.C., Connor, C., Guberman, D., Nelson, D., Maybee, C., Bonem, E., FitzSimmons, J., & Lott, E. (2019). Creating Student-Centered Learning Environments and Changing Teaching Culture: Purdue University’s IMPACT Program. National Institute for Learning Outcomes Assessment (NILOA).

Palmer, M. S., Bach, D. J., & Streifer, A. C. (2014). Measuring the promise: A learning‐focused syllabus rubric. To Improve the Academy: A Journal of Educational Development, 33 (1), 14-36.

Research indicates that syllabi can increase student motivation and create equitable learning environments through transparency about key expectations for student learning and engagement. Consistent with the University’s Course Syllabus Policy, all courses at Saint Louis University are expected to have a syllabus, and all syllabi are expected to provide students with basic information about key aspects of the course.

Below are the required syllabus components for all SLU courses, as well as recommended syllabus components and other considerations that can enhance syllabi. Click the down arrows next to each header to expand the text and learn more.

Please note: Academic units and programs (like the University Core) may require you to include additional information in your syllabus. Please check with program leaders if you need information about additional, program-specific syllabus content you should include.

Required Syllabus Components

The University's Course Syllabus Policy aims to ensure that all students have access to consistent information about their courses and about University-level policies. The policy identifies nine components that must be a part of every course syllabus. These nine components constitute a minimum; academic units may require additional components, and instructors may choose to include other information. The policy specifies the information that must be included in every course syllabus, but it does not dictate a particular format or order for how this information is presented in a syllabus. Academic units may require additional components to be included in course syllabi, and individual instructors certainly will want to add other course-specific information, as well. Required syllabus statements are available as a module in the Canvas Commons, for those who wish to import the statements directly into their Canvas courses. Click here for a printer-friendly version.

a. Course number/section

b. Course meeting time(s) [if applicable]

c. Location [if applicable]

d. Pre-requisites/Co-requisites [if applicable]

e. Catalog Course Description

a. Instructor name (including TA and peer instructors, if applicable)

b. Where, when, and how to contact the instructor

a. List course learning outcomes, objectives, and/or competencies

a. Textbooks and/or course texts

b. Other materials and/or equipment (e.g., calculators, art supplies, lab safety equipment, medical equipment, hardware requirements, software access, virtual proctoring requirements, digital storage devices, special clothing, musical instruments, etc.)

a. List of components on which students will be evaluated (e.g., exams, projects, essays, participation, presentations, etc.)

b. Grading scale(s) governing the course

c. Policy on late or missing work/exams

d. Penalties on missed classes and/or tardiness [if applicable]

e. Catalog Course Description

Insert and/or link to the required Disability Accommodations Syllabus Statement

Note: Due to accreditation requirements, regulatory differences, and/or location-specific resources, the School of Law, the School of Medicine, and SLU Madrid have their own standard language for syllabus statements related to disability accommodations. Faculty in those units should seek guidance for syllabus requirements from their dean's office.

Insert and/or link to the required Title IX Syllabus Statement

Note: Due to accreditation requirements, regulatory differences, and/or location-specific resources, the School of Law, the School of Medicine, and SLU Madrid have their own standard language for syllabus statements related to Title IX. Faculty in those units should seek guidance for syllabus requirements from their dean's office.

Recommended Syllabus Components

In addition to the nine required components listed above, many instructors also find it useful to include information about or guidance on a range of other topics. The following list is drawn from common practices at SLU, as well as from the literature on effective syllabus construction and on creating inclusive courses that support student learning and success. This list is by no means exhaustive or in order of priority. Note: For some academic units, items on this list also may be required. Click here for a printer-friendly version.

- An expanded description of the course, its priorities, key concepts, etc.

- Course schedule with due dates for assignments, exams, reading, and other activities

- Disclaimer about the possibility of changes to the course schedule

- Description of informal learning activities students will engage in (e.g., informal in-class activities, participation expectations, service-learning experiences, etc.)

- Articulation of the link between course assignments/activities and state learning outcomes, objectives, and/or competencies

- Unit-level academic honesty policies and practices [if applicable]

- Course-specific guidance on academic honesty

- Statements of professional ethics or codes of conduct [if applicable]

- Insert a basic needs security syllabus statement (like this one, which was developed at SLU to alert students to campus resources for things like food and shelter insecurity)

- Course etiquette/civility policies or other expectations about interactions between and among members of the class

- With a significant number of SLU courses now being conducted via various distance education modalities, a University-wide recommended syllabus statement on distance education etiquette is warranted. This statement is recommended for all syllabi for all courses at all locations (except the Madrid Campus) offered by the colleges/schools and other academic units reporting to the University Provost.

- Information about what will happen in cases of inclement weather

- Information about relevant safety/security protocols and procedures (e.g., location of eye wash stations, active shooter response, etc.)

- Distinction between "excused" and "unexcused" absences [if applicable and consistent with University attendance policy]

- Statement that student work in the course may be used in course/program assessment

- Information about requirements for experiential/off-campus learning (e.g., liability waiver, background check, internship learning contract, service expectations, etc.)

Other Considerations for Course Syllabi

Below are additional suggestions drawn from the literature on effective syllabus construction and adopted by some SLU instructors. The Reinert Center for Transformative Teaching and Learning can assist instructors who wish to learn more about items on this list. The Reinert Center website also may provide additional information about these considerations. Click here for a printer-friendly version.

A graphic/visual representation of the major components of a course can help students connect to the larger purpose of a course and/or to better understand the relationships among the components of the course. Learn more about the content of a graphic syllabus here.

Sharing a brief description of your philosophy of teaching can give students a way of understanding what they will experience in your course and why.

Explaining what constitutes successful "engagement" or "participation" in your course helps to make those expectations explicit and visible for all learners. This can be especially helpful for first-generation and international students, as well as others whose backgrounds may not have prepared them well to understand the "hidden rules" of successful academic engagement.

Consider sharing tips for how to be successful in the course. For example, you might provide guidance on effective study strategies for your particular content area or tips for how to read course content effectively. Generic study or reading strategies may not work for your particular discipline or the kinds of concepts or texts you teach. Being transparent about what successful students do in your course or your discipline can help students meet your high expectations.

Investment banking is considered a lucrative field. Entry-level jobs quickly provide six-figure salaries. Senior investment bankers can earn tens of millions of dollars every year. Getting to the top of the investment banking field is a multi-step process that requires a combination of education, ambition, hard work, skill, experience, connections, and often good luck. Learn more about the key steps for how to become an investment banker, including the degrees you need along with the importance of internships and networking.

Key Takeaways

- A degree from an Ivy League college or other prestigious school can help you land a job in investment banking.

- Earning an MBA is part of the traditional path to an investment banking career.

- An advanced degree in mathematics is also highly prized by investment banking companies.

- You will likely face licensing requirements once you are hired by a firm.

College Degrees

A college degree in finance or economics is typically the starting point for entry-level jobs at an investment bank. Accounting and business are also common educational backgrounds. While it is true that liberal arts majors can possibly get jobs on Wall Street, you'll have much better chances of getting the right job with math or business degrees.

Major investment banks recruit from the best colleges and universities in the world. In the U.S., new investment bankers are often chosen from Ivy League schools. In the U.S., they may choose from, for example, Harvard or Yale, In Great Britain, they may choose from the London School of Economics, the University College London, or the University of Oxford.

However, there are always exceptions. You can potentially go to a less prestigious institution and still achieve your goals of becoming an investment banker. But choosing the right school and the right field of study will help improve your chances of landing a job at a major investment bank.

Your grades are also important for landing a job in investment banking. Graduating at the top of your class will put you in a good position to draw the attention of campus recruiters and hiring managers.

There are roughly 4,000 investment companies in the United States, but fewer than two dozen are significant on a global scale. Consider carefully whether you want to work for an international entity or a smaller company.

Advanced Degrees

While you can get a job with a bachelor’s degree, having an advanced degree is another way to improve your prospects. A Master of Business Administration (MBA) or an advanced degree in math can add to your appeal. A chartered financial analyst (CFA) certification can help, too.

Internships in Investment Banking

Internships provide a path for students and recent graduates to land full-time employment in many professions, including investment banking. An internship gives you an opportunity to try out your desired field, gain exposure to the culture, get work experience, and impress potential employers. It’s an excellent way to start your career. Of course, like entry-level positions, internships at investment banks can be very competitive.

Value of Networking

Investment bankers spend much their time selling. They are the movers and shakers behind mergers and acquisitions of Fortune 500 companies, initial public offerings (IPOs) of private companies, and other high-finance deals. Networking is a critical part of the job, and perhaps even more so for those seeking to enter the field.

Of course, before you land your first megadeal, you need to land a job. Selling yourself will be your first task. You need to mix and mingle with people who have the power to hire you or who can recommend you to people who do the hiring. And you need to make a good impression.

Having connections like a parent, uncle, cousin, or family friend who work in the business or who have good contacts can also help you land a job. If you are lucky enough to have those connections, you can leverage them toward your goal of becoming an investment banker.

Making a Good Impression

If you're interested in a career in investment banking, you also need to think about what impression you are making in terms of self-presentation and other social cues.

Investment bankers work with and for some of the world’s richest, most successful people. There is an expectation of both discretion and class in how bankers present themselves. Dressing well and carrying yourself in a professional and congenial manner is very important if you want to break into the industry.

A study by the U.K. government’s Social Mobility Commission provides insight into how important it is for professionals to behave appropriately, dress professionally, and adhere to a dress code. If dressing fashionably for an investment banker profession wasn't part of your background, you can learn quickly to blend in during your early years in this field, according to some participants included in the study.

Licensing

To practice investment banking, you will need to be licensed by the Financial Industry Regulatory Authority (FINRA). Typically in the U.S., you will first be hired by a firm then the firm will sponsor you in the licensing process. You may have to get Series 63 and Series 79 licenses, which are required by many firms, but firms requirements regarding licensing can vary.

What Exactly Do Investment Bankers Do?

An investment bank is essentially a financial institution that serves as an advisor to companies, governments, or individuals. Investment bankers work at these banks and often oversee projects such as initial public offerings (IPOs) that help their clients raise money.

Do Investment Bankers Get Paid Well?

Investment banking is considered a lucrative career. You can easily earn six figures or more in this field, including in starting positions. Investment bankers earned an averaged of $334,136, according to Glassdoor estimates as of 2023.

What Are Examples of Investment Banks?

Some examples of major investment banks include JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Bank of America Merrill Lynch.

The Bottom Line

After getting the best education, choosing your major, and networking, then actually landing a job is an important step in the right direction. From there, keeping the job and advancing through the ranks are your next challenges in being an investment banker. If you want the financial benefits of becoming an investment banker, such as a lifestyle of driving Ferraris or vacationing on the French Riviera, you’re likely going to have to put in many years of hard work.

So, you’re considering investing in stocks, cryptocurrencies, or something similar, but don’t know where to start? There are tons of apps out there that can help. Whether you’re planning to invest a little or a lot, there’s an app that can work for you.

These apps are not only great for trading, but they can also help you learn more about different companies and investment opportunities so you can make informed decisions before spending a penny.

Now, you might wonder, which app is the best for beginners? Well, several great options are available for both Android and iPhone users. Whether you’re rocking a Google Pixel 8 or an iPhone 15 Pro, you’ll be able to find an app that works for you.

If you’re looking for more great financial apps, see our picks for the best cryptocurrency apps and best stock-trading apps.

Stash

Stash is an innovative mobile application that simplifies investing in stocks, bonds, and exchange-traded funds (ETFs). With Stash, you can start investing with as little as $5 and even purchase fractional shares. This means that no minimum investment is required to get started.

One of the most exciting features of Stash is the Stock-Back Card. This unique feature provides rewards on everyday spending that can be used to invest in your portfolio. You can earn money while spending and then invest it in your portfolio. This card makes it easy to build your portfolio passively without making any additional investments.

Stash also offers a variety of tools and resources to help investors make informed decisions. You can easily track your investments, monitor your portfolio performance, and get personalized investment recommendations based on your financial goals and risk tolerance.

Overall, Stash is a user-friendly and accessible investment platform that allows anyone to invest in their future, even those with a limited budget.

Robinhood

Robinhood is an investment platform that doesn’t charge any commission fee and allows users to trade various financial instruments like stocks, ETFs, options, and cryptocurrency. The service has a user-friendly interface, making it easy for both novice and experienced investors to use. Robinhood has fractional share purchasing, which lets you buy a portion of a share of stocks and ETFs. In other words, you can invest in companies with high stock prices without breaking the bank.

Robinhood also provides various educational resources like articles, videos, and more to help you learn about investment strategies, market trends, risk management, and more. This makes Robinhood an ideal platform for anyone who wants to learn about investing.

Fidelity Bloom

If you’re new to saving or investing, Fidelity Bloom is the perfect solution. The platform offers a user-friendly interface and many educational resources to help you learn about investing and financial management. You can easily set financial goals, monitor your expenses, and start saving for the future.

Fidelity Bloom has several unique features, such as nudges and challenges, designed to motivate you to save and spend money wisely. Nudges are personalized messages offering suggestions for improving your financial habits, while challenges are fun tasks encouraging you to save money or learn new financial concepts. The platform also incorporates behavioral science insights to help you make better financial decisions.

As a new Fidelity Bloom user, you can choose between two brokerage accounts: Save and Spend. You can quickly transfer funds between these accounts to help you achieve your saving goals.

Invstr

Invstr is an excellent app with tons of features to help people new to investing. It’s got a big community, educational materials, and even a game where you can pretend to trade stocks. This game is helpful because you can learn about investing without putting real money on the line.

Invstr has other resources like webinars, videos, and articles covering everything you need to know about investing and making it easy to learn and grow your knowledge.

And perhaps the most remarkable thing about Invstr is that it also has a community of people who are all into investing. You can talk to them and get ideas or share your own experiences. It’s like a community of people who want to help each other succeed in the stock market.

SoFi

SoFi is an excellent investment app that provides various features particularly suited for novice investors. One of the key features that makes it stand out is the built-in robot adviser that helps you create a customized investment portfolio based on your financial goals and risk appetite. This tool ensures you are well-equipped to make informed investment decisions that align with your needs and preferences.

SoFi’s social trading feature is another unique feature that offers a fantastic way to learn from other investors. The app enables you to follow other investors, observe their buying and selling activities, and even replicate their trades. This feature allows you to emulate the strategies of successful investors and potentially benefit from their expertise.

SoFi also provides a platform for sharing your investment ideas with others. This feature is handy for beginners who want to learn from others and get feedback on their investment ideas.

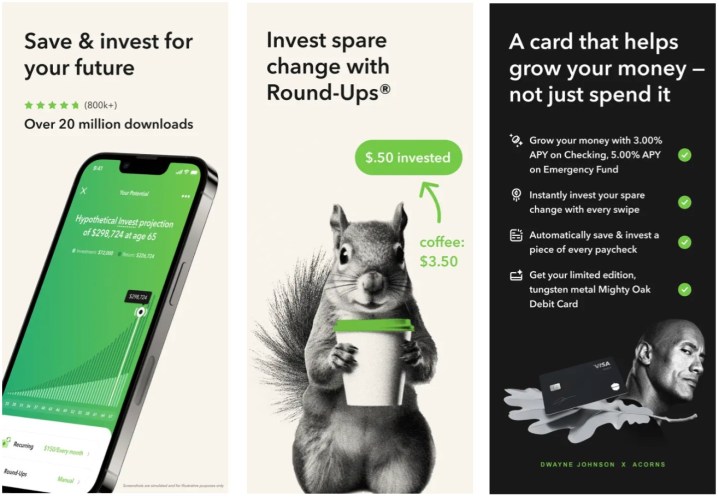

Acorns

Acorns could be your app if you’re new to investing and want to start small. It’s a micro-investing app that rounds up your purchases to the nearest dollar and invests the difference automatically. As such, you don’t have to worry about breaking the bank!

Getting started with Acorns is super easy and takes just a few minutes. All you need to do is link your bank account to the app, and you’re good to go. Acorns will start rounding up your purchases, and before you know it, you’ll have a small investment portfolio to call your own.

The app is very user-friendly and straightforward to navigate. You can set up recurring investments, keep an eye on your portfolio, and withdraw your funds anytime. The app offers investment advice and guidance to help you make informed decisions.

Public

If you want to learn more about investing, one of the best ways to do so is by interacting with experienced investors. This is where the Public app comes in handy. You can follow the investments of other investors to get insights into what they are buying, which can help you make better-informed decisions when trading on your own. Public offers a comprehensive list of educational resources, such as articles, videos, and more, to further support you.

Public is similar to other trading apps, allowing you to buy and sell various stocks, cryptocurrencies, ETFs, and more. You can also buy fractional shares, which lets you start investing for as little as $5.

Greenlight

Teaching children about investing is crucial, and the Greenlight app can help facilitate this learning process. While the app primarily serves as a savings and chore app, it also allows parents and kids to invest in stocks and other assets together. With thousands of stocks and ETFs available, users can access various investment options. The app’s fractional trading feature allows users to buy and sell stocks in small fractions, making it easy for children to get started with investing and saving money in general.

The app is affordable, and families can start investing with a low-cost membership. Overall, the Greenlight app is an excellent tool for teaching children about investing. It provides a user-friendly platform for families to collaborate on their investment journey, making the process accessible and straightforward.

Betterment

If you’re looking for an effortless and stress-free way to invest your money, you might consider using Betterment, a robo-adviser app that can help you achieve your financial goals. Betterment is a platform that combines advanced algorithms and human expertise to manage your portfolio and help you create a personalized investment plan tailored to your needs. With Betterment, you can quickly build a diversified portfolio that aligns with your risk tolerance, investment goals, and timeline.

Betterment’s user-friendly interface and intuitive design make investing simple and convenient. You can easily track your progress and monitor your investments from the comfort of your home or on the go. Betterment also offers fractional investing, meaning you can invest in various stocks and bonds with just a tiny amount of money. This makes it a perfect solution for people who are just starting to invest or don’t have a lot of disposable income.

Schwab Mobile

Schwab Mobile is an advanced and user-friendly application designed for stock trading. It was developed to provide its users with an exceptional trading experience that is both easy to use and efficient. The trusted name of Charles Schwab backs the app, and it features a comprehensive dashboard that provides real-time updates, breaking news, and price charts for easy analysis. With Schwab Mobile, users can easily trade stocks, ETFs, mutual funds, etc. The app also allows users to create custom watch lists to keep track of their favorite options and monitor their investments closely.

Schwab Mobile is also an excellent choice for new traders. The app provides access to various investing guides, videos, and podcasts, making it easier for beginners to learn about investing and make informed decisions.

Editors' Recommendations

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

As you build your investment portfolio, you'll likely learn that there are more assets to invest in than just stocks and bonds - and that diversification is an important way to balance risk and reward. In fact, many investors use gold to diversify their investments as a way to protect their portfolios against a number of market risks.

However, some investments are better to buy and sell on a short-term basis and some are better to hold for the long run. Where does gold fit on that scale? How long should you hold gold in your investment portfolio? The answer varies but it's generally long-term.

Learn more about your gold investing options now.

How long should I hold a gold investment?

Gold isn't the kind of asset that's going to produce impressive short-term returns. In fact, gold usually has a relatively slow and steady growth rate. Moreover, when you invest in physical gold, you'll generally pay a dealer fee above spot prices, which may take some time to recover from. However, you may be able to gain exposure to gold and avoid that fee by purchasing shares of gold ETFs.

Nonetheless, all of that underlines that gold is a long-term asset. In fact, most people who invest in the commodity will likely hold at least a portion of their portfolio in the precious metal for the rest of their lives. Here's why:

Gold protects you against inflation

The price of gold generally moves alongside inflation. So, as the prices of goods and services rise, you can expect the price of gold to follow. That's an important quality for assets on the safe haven side of your investment portfolio. After all, during periods of high inflation - like what we've been experiencing in recent years - the dollar loses purchasing power.

On the other hand, during these times gold tends to rise in value, which could protect the purchasing power of your portfolio. As such, when you add gold to your portfolio, you shouldn't do so as a short-term trade but rather as a long-term protection play.

Protect your portfolio from inflation with gold now.

Gold protects you against market volatility

Protection against inflation isn't the only way gold can bring a higher level of safety to your portfolio. The commodity is also a strong source of protection against stock market volatility.

When investors are concerned that the stock market is headed into bearish territory, they tend to sell their riskiest positions and use that money to invest in safe haven assets. Gold is one of those assets. As such, when market conditions are concerning, gold tends to see an influx of demand.

As the law of supply and demand suggests, when investors flood gold as a way to protect their portfolios, the price of the commodity tends to rise. So, gold could produce gains when the bears have control of the market - making potential losses in other areas of your portfolio easier to swallow.

How your safe haven allocation should change over time

Since there's always a need for safe haven assets in an investment portfolio, you probably shouldn't ever get rid of 100 percent of your gold holdings. On the other hand, you may want to increase them over time.

It's generally advised that investors take bigger risks when they're younger. As you age, you should adjust your portfolio for less risk. After all, you'll have less time until retirement. As such, there's less time to recover if something goes wrong.

A general rule of thumb is to use your age to dictate the percentage of your portfolio that you allocate to safer investments. For example, if you're 35 years old, you should allocate 35% of your portfolio to safe havens and 65% to stocks and other high-growth investments. On the other hand, when you're 60 years old, you should allocate 60% to safe havens and only 40% to high-growth assets. If you follow this basic, yet effective asset allocation strategy, you'll have more room in your portfolio for investments in gold each year.

That all being said, most experts advise limiting your gold investment to no more than 10% of your overall portfolio.

The bottom line

If you're looking for an asset that makes for great short-term trading opportunities, gold probably isn't what you want. Instead, when you invest in gold you should do so with a long-term time horizon. Ultimately, it's important to balance risk and reward for as long as you invest and gold investments can help with that balance. So, chances are that you'll always have room for gold in your investment portfolio.

About Chimera Investment

Related People & Companies

CIFC mission | CIFC outline | CIFC certification | CIFC exam format | CIFC tricks | CIFC reality | CIFC questions | CIFC exam format | CIFC education | CIFC certification |

Killexams Exam Simulator

Killexams Questions and Answers

Killexams Exams List

Search Exams